3 min read

‘Madness’ of US real estate AML regime will trigger new laws

![]() AML RightSource

:

September 21, 2020

AML RightSource

:

September 21, 2020

Experts have branded failures in the US real estate anti-money laundering (AML) regime ‘madness’. They predict legislation is inevitable, and that rules and regulations will extend to cover real estate professionals.

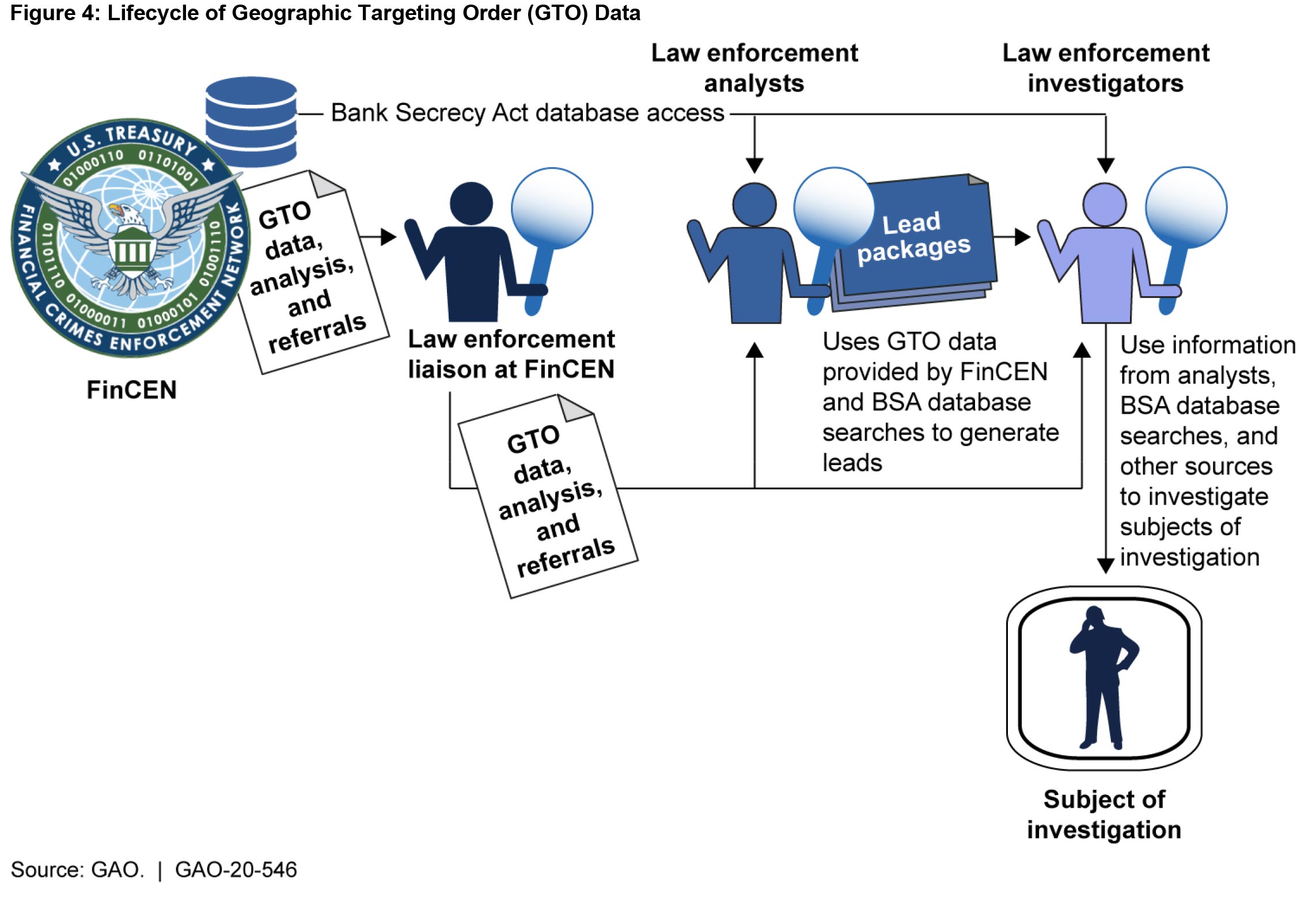

An unfavourable report on real estate geographical targeting orders (GTOs) – which require financial institutions in one area to report transactions – has led to calls for new laws to make AML more effective.

Congress has also proposed a register of beneficial owners – the people who ultimately own or control the assets – to bolster enforcement.

What are geographic targeting orders?

Criminals have long looked to launder ill-gotten gains by buying US properties with cash, through shell companies. This helps hide their identities and sources of funds. Previously, AML regulation of real estate focused on loans, which meant launderers could get past reporting requirements by paying cash and avoiding banks.

Laundering through US property has been rife, with the Financial Crimes Enforcement Network (Fincen) calculating that 599 properties worth over $147 million were subject to forfeiture between 2012 and 2015. And that is just the ones that were detected.

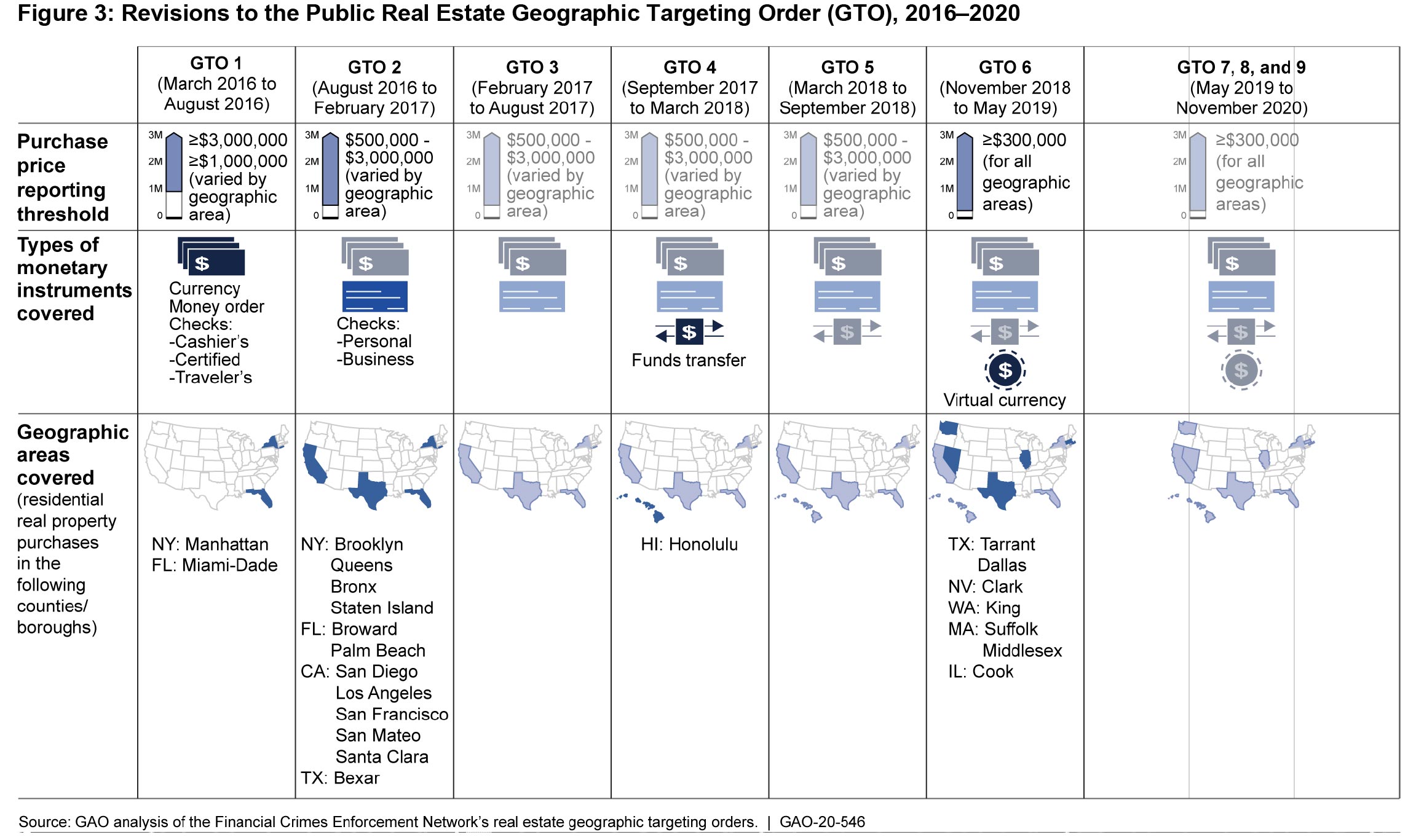

To help close this regulatory gap, Fincen launched real estate GTOs in 2016. These require financial institutions in targeted areas – mostly major cities – to report residential property cash transactions above a threshold (currently $300,000). In addition to cash, they cover purchases involving virtual currency, fiat currency, wires, cheques, money orders, or fund transfers. Strangely, the orders are not currently permanent – they last 180 days but can be renewed.

Review and recommendations

GTOs have had some success in helping law enforcers, but Congress still had concerns about their effectiveness, so asked the US Government Accountability Office (GAO) to review them.

Jodi Avergun, chair of white-collar defence and investigations at Cadwalader Wickersham and Taft, said one concern was the lack of information released about how GTOs were used to target criminals. Fincen was also not monitoring GTO reports sufficiently, she says.

GAO’s report, published in July 2020, was far from glowing. It highlighted the benefits of GTOs, including their identification of numerous attempts to launder money through real estate.

However, the report also identified significant weaknesses. It said Fincen failed to:

- coordinate sufficiently with law enforcers, particularly on how to share GTO data

- monitor compliance by title insurance companies

- consider whether formal rules should replace GTOs

- address how to apply AML requirements to the real estate industry.

GAO recommended Fincen provide additional direction for GTOs, including how to plan for oversight, outreach and evaluation. This should include how the agency will oversee businesses, inform and obtain feedback from enforcers, and evaluate GTOs.

Reaction

Fincen agreed with GAO’s recommendations and is reviewing and revising GTO procedures.

Avergun said the failures should lead to a requirement to audit GTOs; more effective punishment for non-compliance; and more transparency about issuing and reporting.

Jim Richards, principal of RegTech Consulting, also highlighted the report’s ‘disturbing’ finding that five of the main federal enforcement agencies do not track systematically the types of Banking Standards Act (BSA) reports used in investigations.

‘We’re 50 years into BSA-related reporting,’ said Richards. ‘Fincen’s authority is to require institutions to file reports that are in investigations. But the main agencies that use those reports can’t tell us which are most useful. It’s madness. It is incumbent on Congress to pass legislation.’

Some law enforcers warned it was too early to assess GTOs’ usefulness, because investigations can take years to complete and the orders’ full value cannot be assessed until such completion. Nonetheless, enforcers supported making GTO requirements permanent because the orders do generate investigative leads and deter money laundering.

Beneficial ownership flaws

By identifying beneficial owners who were separately the subject of suspicious activity reports (SAR), GTOs have helped identify potential suspects and led to law enforcement.

So Fincen has filled the gap in collecting beneficial ownership information on account opening, but there is still no requirement to disclose this information at state or federal level. Without this, enforcers have no systematic way of obtaining the information. Congress has therefore proposed a requirement for companies to record beneficial owners on a national register.

Law firm Ballard Spahr says US government officials generally support a register to help close enforcement loopholes. But small business groups oppose a register, citing compliance costs.

Law enforcers support simultaneous use of a national register and GTOs, despite the cost implications, because GTOs make it easier to link beneficial owners to real estate purchases.

Law firm Clifford Chance says it is still not clear whether, when or exactly how the proposal will pass into law, however some kind of AML reform is likely.

Impact on real estate agents

Fincen has not yet decided whether to extend its AML programme and reporting requirements to real estate professionals, including agents and attorneys – but it is assessing this. GAO’s highlighting of Fincen’s failure to address this suggests that AML programmes will be extended to real estate professionals in some way.

Industry groups have warned that the real estate industry is large, de-centralised and ill-equipped for such requirements, and that a federal regulator would struggle to conduct examinations across the industry effectively.

But another trade body said AML obligations should extend to real estate professionals, including agents and attorneys, because they interact more closely with buyers and are more involved in transactions than title insurers.

Ballard Spahr says it appears Fincen is still waiting to see if beneficial ownership registration passes into law before deciding whether to extend rules to the industry.

Streamlining systems

As laws and regulations evolve, many real estate companies will look to improve their AML technology and processes, including around know your customer, adverse media screening, enhanced due diligence, and customer onboarding and monitoring.

Real estate companies can face many challenges in all these areas. For example, isolating relevant data for complex entities is often difficult for compliance teams who need to become more efficient.

They need the ability to perform rapid enhanced due diligence and adverse media screening on complex retail tenants in any country and language. They also may need the ability to prove due diligence findings to regulators with a clear audit trail.