3 min read

How to accelerate onboarding and improve CX in business banking

![]() AML RightSource

:

March 22, 2021

AML RightSource

:

March 22, 2021

The race to differentiate continues to put the banking sector to the test. As Fintech entrants push through barriers to create exceptional digital experiences, all banks are running a race to create innovative customer products and experiences. Part of this push is to deliver a smooth, friction-reduced, customer experience (CX) that delights and builds strong, positive, relationships.

Onboarding banking customers can be a painful exercise. Customer due diligence and AML (anti-money laundering) checks can be lengthy, time-consuming, and costly, impacting both the customer and the bank. The fact is, a smooth onboarding experience makes a bank more attractive; the customer-facing onboarding process, demonstrating in real-terms, the bank’s commitment to customer expectations and needs. As such, a good onboarding experience ultimately leads to better business relationships.

The Digital Banking Report 2020 report corroborates this, stating:

“Done well, (digital) transformation will have the opportunity to increase revenues and decrease costs, positively impacting the customer experience and providing differentiation in the marketplace.”

Onboarding is the first digital touchpoint of the business customer: It is at this point that a tight fit bank-business customer dovetail is created. Getting this vital stage of the process optimized requires intelligence. For the 21st century bank, this intelligence comes in the form of actionable data that can be seamlessly used with existing banking systems.

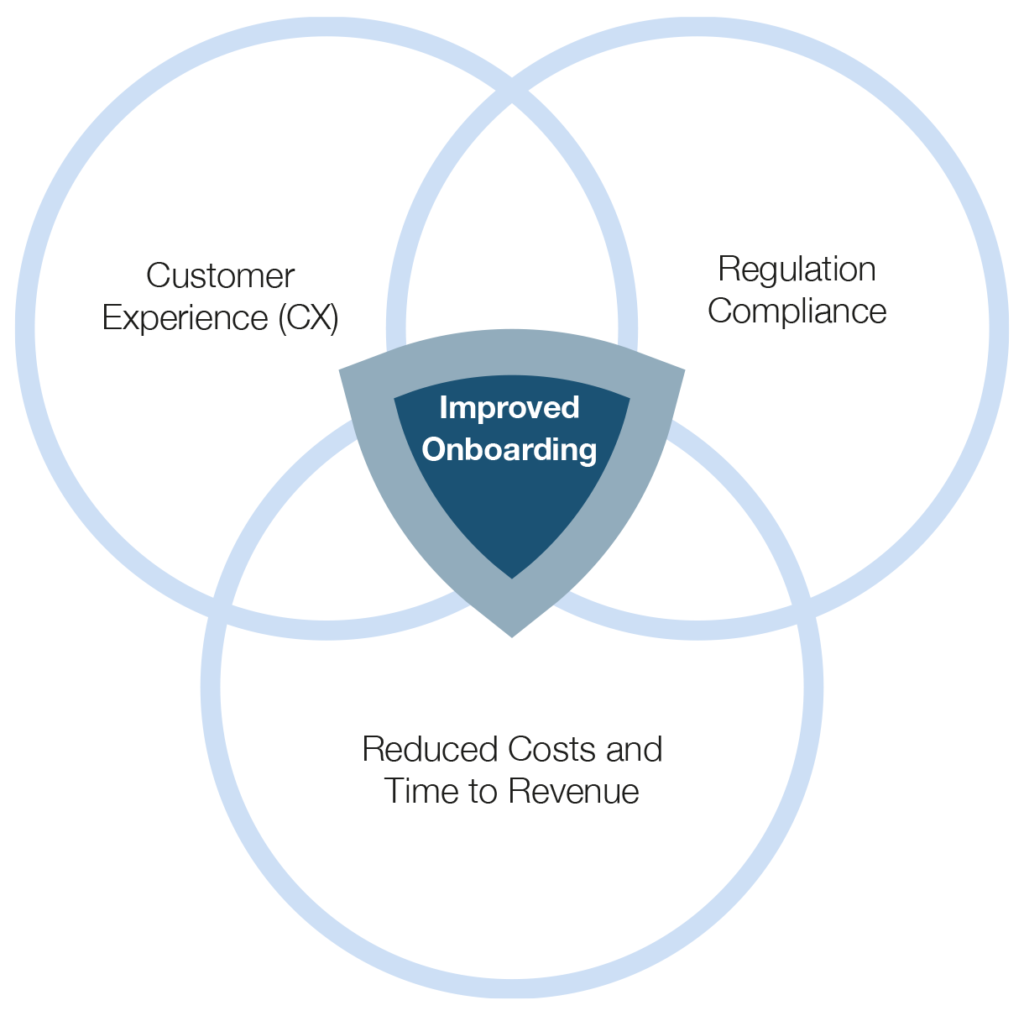

The Three Pillars of Corporate & Investment Bank Onboarding

1. Customer Experience (CX)

Signing up for a business bank account online is a renowned painful experience, requiring extensive data checks and identification which can be teeth-grindingly frustrating for the customer. Busy business customers are likely to be even more critical of slow and cumbersome onboarding than the individual. Offering a smooth CX is a keen differentiator, especially now that challenger banks have introduced the concept of rapid KYC to the world. A great CX is about embracing a customer and making them feel like their time and patronage is valuable. Lengthy, onerous data collection and checking processes, create hurdles to a great relationship. Ultimately, the KYC/CDD required by banking regulators can act as a barrier to this relationship if the process is too slow or too invasive.

Customer experience has been shown to trump product and price as the number one reason for loyalty to a brand. Designing for a great customer experience has become a key requirement of the digital bank.

The result of a poor CX shows how important a good one is. A Fenergo report found that a poor CX costs a financial institution around $10 billion in revenue per year. Achieving a great CX is an involved process requiring integrated design across the user interface and user journeys (UI/UX). But an important aspect in all of this, and one that informs the design, is the optimization of data used in KYC. Summed up in recent research, one in three financial institutions have lost customers due to inefficient or slow onboarding.

2. Compliance with financial regulations

Money laundering is a massive issue across the banking sector. The United Nations estimate that the annual amount of money laundered globally is 2 – 5% of global GDP ($800 billion – $2 trillion US dollars). The result is that regulations are updated to include ever more stringent requirements in an attempt to manage these losses.

2020 saw major fines issued to FIs across the world for AML/KYC and other regulation violations. Data from Fenergo show that fines against financial institutions through July 2020 have reached $5.6 billion. These include:

- $900 million fine issued by AUSTRAC to Westpac Bank in Australia for violations of multiple provisions of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/ CTF Act).

- $150 million to Deutsche Bank in Germany, both the EU and U.S. regulators finding noncompliance discrepancies.

3. Reduced Costs and Time to Revenue

The time to revenue is one of the biggest single pain points large banks are facing, both in terms of lost revenue and diminished customer experience. Researchers at Oliver Wyman have found that it typically takes 90-120 days to onboard corporate banking customers, which is a staggering amount of time in comparison to some challenger banks are offering.

Onboarding commercial banking clients is typically made up of eight steps and there is significant complexity involved in the due diligence process compared to the retail banking world. However, some of the biggest delays are early on in the process around the initial request, document gathering and background verification stages. If banks had better access to global KYC and AML data to verify corporate structures, shareholders, directorships and UBOs they could accelerate some of these steps.

The cost of performing KYC/CDD can be off-putting. In terms of meeting KYC requirements for compliance, a large FI requires an average of 307 employees to work towards meeting standards. The associated costs of that kind of people-based work is not insignificant.

Download the white paper

Reducing the friction: How to accelerate onboarding in business banking

Reducing the friction: How to accelerate onboarding in business banking

This paper looks at the pillars, drivers, pain points and potential solutions in CIB onboarding for business, including:

Finding a solution through data

Reducing the Time to Revenue

Solving for a great CX in CIB